Whitepaper #3

Low cost digital solutions for Manufacturing SMEs: Priority Solution Areas

The aim of this paper is to provide an understanding of the priority digital solution areas for manufacturing SMEs. In this study, we examined the digitalisation preferences of 128 SMEs working with a predefined catalogue of 59 digital solution areas. Out of all participants in the study, 86% ranked one of the top 5 items as a key priority for their business and 98% of respondents ranked one of the top 15 as priority. This contribution can help increase accessibility to digitalisation for manufacturing SMEs by allowing solution developers to concentrate efforts in these priority areas.

Authors: Benjamin Schönfuß, Duncan McFarlane, Gregory Hawkridge, Liz Salter, Nicky Athanassopoulou, Lavindra de Silva

ISSN: 2633-6839, REF ENG-TR.009

Date: August 2021

Keywords: Industry 4.0, Manufacturing, SMEs, Digitalisation, Digital Manufacturing on a Shoestring

Acknowledgements:

This work was supported by the Engineering and Physical Sciences Research Council [grant number EPSRC: EP/R032777/1].

Contents

1. Introduction

The work reported here is part of the Digital Manufacturing on a Shoestring programme which focusses on low cost digital solutions for manufacturing SMEs.

The digitalisation of manufacturing processes has a profound impact on the manufacturing industry. It can lead to increased efficiency, improved product quality, higher capacity, and many other benefits [1,2]. We define digital manufacturing as the application of digital information from multiple sources, formats, and owners for the enhancement of manufacturing processes, value chains, products, and services.

Small and medium sized enterprises (SMEs) face bigger digitalisation challenges than larger companies [3]. However, SMEs represent a large part of the economy. In the UK manufacturing sector, they accounted for 45% of the economic contribution and employed 53% of the workers in 2019 [4,5]. Two challenges, which are specifically pronounced for SMEs, are the perceived high cost and complexity of digital solutions [6,7]. Despite the high relevance, only little research into addressing SME-specific barriers is conducted at the moment [8,9]. We use the term SME in accordance with the guidelines of the European Commission, referring to companies with a headcount of < 250 and an annual turnover of ≤ 50MN € [10].

The aim of this paper is to show that digitalisation priorities are common among many SMEs. SMEs often have more basic digitalisation needs than large companies, however a lot of the available solutions are built and priced to be used at large scale [11]. Identifying common priorities can help address the cost and knowledge barrier by providing direction for research and facilitating standardisation.

2. Capturing digitalisation priority needs of manufacturing SMEs

In this section we present the digitalisation priorities described in this study are derived from a catalogue of Digital Solution Areas, which was developed in a companion paper. A digital solution in this context is a digital system that facilitates a (current or new) activity in a company. A solution area describes the purpose of a solution, without referring to a specific technological implementation.

The digital solutions catalogue comprising 59 solution areas is the starting point for the prioritisation reported in this paper. Using a voting process, the SME participants in this study indicated which of these are of the highest and of medium priority to their business.

The digital solution area prioritisation was determined as part of the series of workshops. The participants were SME owner-managers, or other key management personnel, who were well suited to represent the company priorities accurately. Figure 1 shows the four-step prioritisation process followed during the workshops.

Figure 1: Steps to establishing solution area priorities

Alignment of business goals and digital solution areas is an important success factor for digitalisation in SMEs [12]. To ensure that the representatives had their company goals in mind when prioritising the solution areas, they first reflected on key order winners and business constraints. Order winners (price, quality, delivery, unique value, ethical performance) are competitive factors that address customer needs, while business constraints (people and information, plant and equipment, supply chain, demand, cash) are internal factors that could potentially limit growth [13].

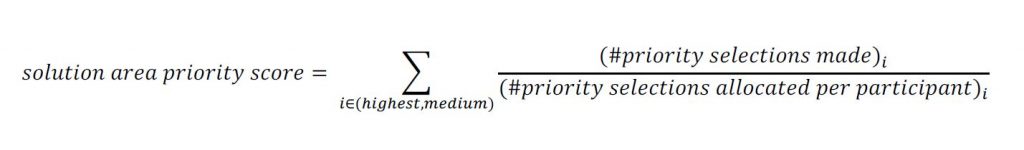

Each participant was then asked to select three highest-priority solution areas that they regarded as important and valuable to their business. A further seven medium-priority selections were allowed to achieve a more nuanced ranking beyond the highest ranked solution areas. To represent both types of priority selections in one unifying ranking, a normalised priority score was derived for each solution area as follows:

3. Digitalisation Priorities for Manufacturing SMEs

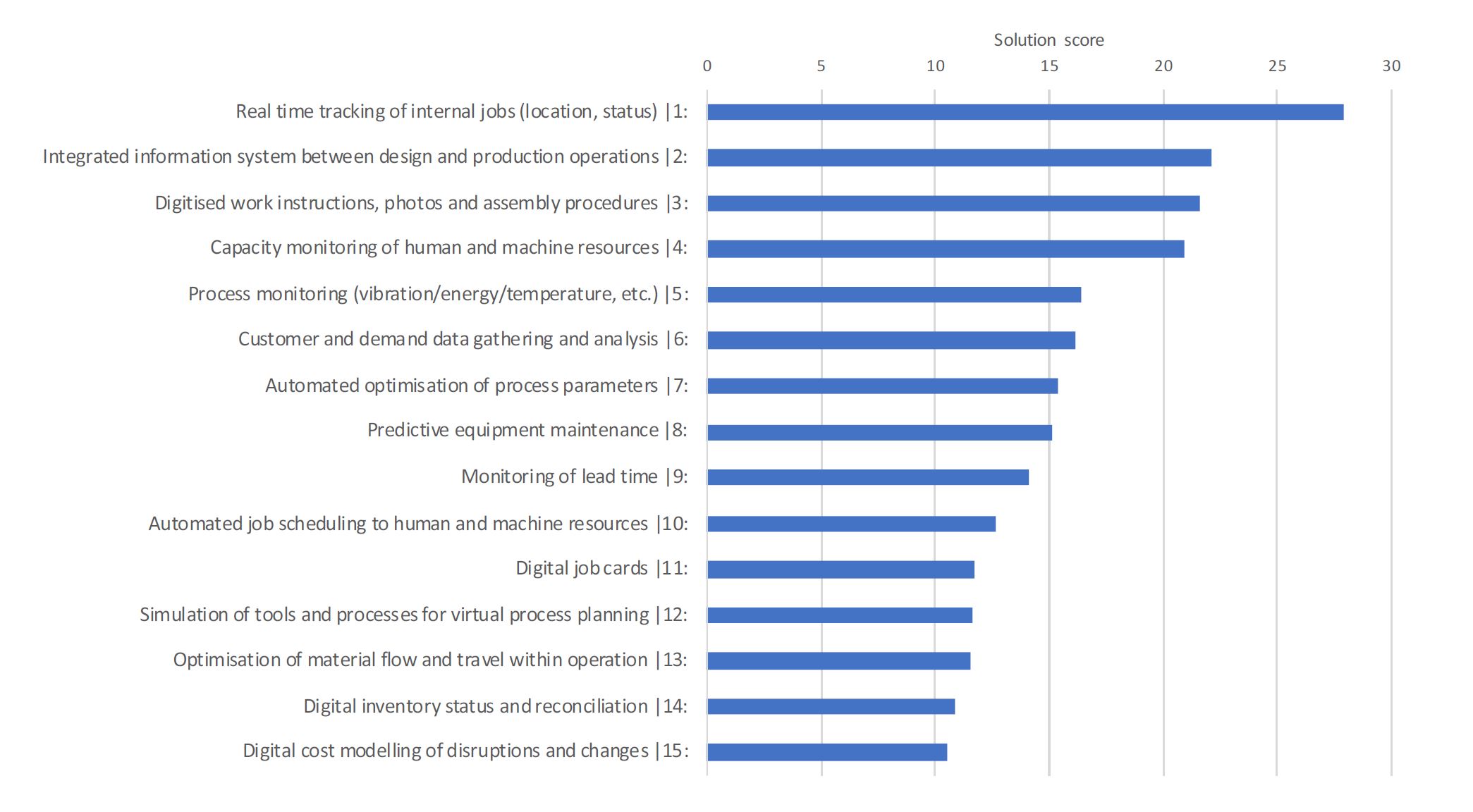

In this section we present the ranking of the top 15 solution areas in the catalogue is shown in Figure 2. 98% of all SME participants voted highest priority for at least one solution area in the top 15. Further, 86% of companies chose at least one highest priority solution area in the top 5. Together with the clearly discernible steps in the score after solution area 1 and area 4, this emphasises that many SMEs do indeed share their most critical digitalisation needs. Furthermore, it reinforces the comprehensiveness of the catalogue, as most companies (99%) were able to identify a solution that is important to their business.

Looking at the top 15 selections in Figure 2, these can be further categorised depending on the kind of benefit they provide. Eight solution areas are categorised under 1) Data Capture and Visualisation, 5 under 2) Data Analysis and Decision, 2 under 4) Support Systems and none under 3) Actuation, even though the catalogue itself contains more solution areas in category 2 than 1. This is not surprising, as category 1 solution areas could be an important first digital priority for many SMEs.

Figure 2: The top 15 solution areas in the catalogue

An important observation was the very high consistency of results between the workshops. Across all workshops, the two solution areas Real time tracking of internal jobs (location, status), and Digitised work instructions, photos and assembly procedures were ranked in the top 5 consistently. This is not surprising, because the typical low volume, high complexity product mix of SMEs often results in heavy reliance on human workers. Both solution areas can help mitigate the resulting variety in output, quality, and necessary training. All but three of the solution areas in Figure 2 were ranked in the top 20 of the catalogue in all of the workshops.

Within the final top 15, all solution areas except digital job cards ranked in the top 15 in at least 3/4 of all individual workshop. We can thus confirm that the ranking is robust. Solution areas below the top 15 show a higher variety due to the few votes they received in total.

For more detail on each of the top 5 solution areas, see Appendix A.

4. Conclusion

This study has identified a clear hierarchy of importance in the catalogue of digital solution areas that was proposed in our companion paper. Over 99% of the 128 participant SMEs in the study rated at least one of the digital solution areas as being highly beneficial to their business, confirming the comprehensiveness of the set.

Approx. 30% of the SMEs in our study chose Digital job cards, the highest ranked solution area, as a priority for themselves. 86% of participants determined one of the top 5, and 98% one of the top 15 solution areas to be important to their business. Hence it is reasonable to conclude that a priority of digital solution areas was established for SMEs. A majority of the solution areas are in the categories of basic data capture and analytics. Two case examples (using evidence from the literature) showed that it is possible to design such solutions using low-cost components, thus addressing the financial resource barrier of SMEs.

The findings are of high practical relevance to manufacturing SMEs, researchers, and businesses in the space of digitalisation. Individual SMEs can profit from the catalogue by saving time on researching potential digitalisation projects for their business, and gaining a research-based overview of the available options. The catalogue can also help focus research endeavours on high-impact issues in digitalisation for SMEs. For solution providers, the catalogue provides a prioritisation of future developments that can be expected to be of high relevance for potential customers.

5. References

[1] S. Doh, B. Kim, Government support for SME innovations in the regional industries: The case of government financial support program in South Korea, Res. Policy. 43 (2014) 1557–1569. https://doi.org/10.1016/j.respol.2014.05.001.

[2] A. Kusiak, Smart manufacturing, Int. J. Prod. Res. 56 (2018) 508–517. https://doi.org/10.1080/00207543.2017.1351644.

[3] S. Brunswicker, W. Vanhaverbeke, Open Innovation in Small and Medium-Sized Enterprises (SMEs): External Knowledge Sourcing Strategies and Internal Organizational Facilitators, J. Small Bus. Manag. 53 (2015) 1241–1263. https://doi.org/10.1111/jsbm.12120.

[4] C. Rhodes, Manufacturing : statistics and policy, 2020. https://commonslibrary.parliament.uk/researchbriefings/sn01942/.

[5] European Commission, List of country SME key figures 2019, SME Perform. Rev. (2019). https://ec.europa.eu/growth/smes/business-friendly-environment/performance-review_en#annualreport (accessed June 3, 2020).

[6] A. Sevinç, S. Gür, T. Eren, Analysis of the difficulties of SMEs in industry 4.0 applications by analytical hierarchy process and analytical network process, Processes. 6 (2018). https://doi.org/10.3390/pr6120264.

[7] D. Horváth, R.Z. Szabó, Driving forces and barriers of Industry 4.0: Do multinational and small and medium-sized companies have equal opportunities?, Technol. Forecast. Soc. Change. 146 (2019) 119–132. https://doi.org/10.1016/j.techfore.2019.05.021.

[8] S. Mittal, M.A. Khan, D. Romero, T. Wuest, A critical review of smart manufacturing & Industry 4.0 maturity models: Implications for small and medium-sized enterprises (SMEs), J. Manuf. Syst. 49 (2018) 194–214. https://doi.org/10.1016/j.jmsy.2018.10.005.

[9] T. Masood, P. Sonntag, Industry 4.0: Adoption challenges and benefits for SMEs, Comput. Ind. 121 (2020) 103261. https://doi.org/10.1016/j.compind.2020.103261.

[10] European Commision, User guide to the SME Definition, 2015. https://doi.org/10.2873/782201.

[11] A. Moeuf, R. Pellerin, S. Lamouri, S. Tamayo-Giraldo, R. Barbaray, The industrial management of SMEs in the era of Industry 4.0, Int. J. Prod. Res. 56 (2018) 1118–1136. https://doi.org/10.1080/00207543.2017.1372647.

[12] W. Li, K. Liu, M. Belitski, A. Ghobadian, N. O’Regan, e-Leadership through strategic alignment: An empirical study of small- and medium-sized enterprises in the digital age, J. Inf. Technol. 31 (2016) 185–206. https://doi.org/10.1057/jit.2016.10.

[13] N. Slack, S. Chambers, R. Johnston, Operation Management, 2010.

[14] F. Doyle, J. Cosgrove, Steps towards digitization of manufacturing in an SME environment, Procedia Manuf. 38 (2019) 540–547. https://doi.org/10.1016/j.promfg.2020.01.068.

[15] A. Amaral, P. Peças, SMEs and Industry 4.0: Two case studies of digitalization for a smoother integration, Comput. Ind. 125 (2021). https://doi.org/10.1016/j.compind.2020.103333.

[16] A. Toapanta, D. Zea, C. Tasiguano, M. Vera, C. Paspuel, Machine Monitoring Based on Cyberphysical Systems for Industry 4.0, in: M. Botto-Tobar, M. Zambrano Vizuete, A. Díaz Cadena (Eds.), CI3 2020, AISC 1277, Springer International Publishing, Cham, 2020: pp. 117–127. https://doi.org/10.1007/978-3-030-60467-7_10.

[17] B.J. Ming Heng, A.K. Ng, R.K.H. Tay, Digitization of work instructions and checklists for improved data management and work productivity, 4th Int. Conf. Intell. Transp. Eng. ICITE 2019. (2019) 79–83. https://doi.org/10.1109/ICITE.2019.8880219.

Appendix A: Further details of the Top 5 Digital Solution Areas

For many of the solution areas, previous case studies (see e.g., [14–17]) suggest that a low-cost implementation, heavily based on open-source software and low-cost components is possible.

The top solution is real time tracking of internal jobs (location, status). We define the scope of this area as “track and display where all jobs are at any given time, showing their shop floor location and”. The popularity of the solution area is likely based on the clearly visible benefits it can bring to an SME that uses paper-based job cards. A real time overview of the current location of jobs can help with more accurate planning of capacity, identification of bottle necks, and jobs that did not progress for a certain time. A potential stand-alone low-cost implementation has been discussed in [15]. In the most basic deployment, this solution does not require more than one or several barcode scanners (and barcodes on the job card), a database, and a simple visualisation frontend. It could be expanded by a better integration with the job database or ERP system to give more information on the scanned jobs. Interaction with other solution areas such as digital job cards (rank 11) or monitoring of lead time (rank 9) are also possible.

An integrated information system between design and production operation is another solution that is requested by many SMEs. The definition is to ensure that production operations have timely access to the latest design revisions and provide them with a mechanism for giving feedback to the design team. More broadly, this solution can be interpreted as facilitating information exchange between different departments of SMEs. An example of a solution based on an open-source internal message board that could fulfil such a function is given in [15]. Other options could be an integration with other solutions such as digitised work instructions (rank 3).

Digitised work instructions, photos and assembly procedures (rank 3) aim to provide the operator with high quality instructions for an operation, together with guidance on quality standards and other supporting documentation. A reduction of time wasted on search for instructions, reduced coordination effort (e.g., possibility to update instructions), and long-term documentation were identified as main benefits in a recent study [17]. Additional benefits can further be envisioned in the manufacturing area. E.g., the use of dynamic content, such as videos, can facilitate infrequent procedures, and employee training.

Accurate information about capacity, especially of expensive machinery, can be very valuable to shop floor managers. The fourth ranked solution, capacity monitoring of human and machine resources, can fulfil this functionality with a basic setup consisting of a dashboard and sensors on the relevant machines. A way to retrieve machine status data by measuring energy usage, without interfering with the actual machine is described in [14]. This add-on style implementation has the advantage that it does not cause warranty or licensing issues compared to directly reading the data from the machine. A simple comparison of available and expected capacity can inform management about potential problems in the workflow, bottle necks, and similar waste. A better estimate of the capacity of human workers could be achieved by integrating with other solutions such as the top ranked real time tracking of internal jobs (location, status).

Process monitoring (rank 5) goes one step beyond the previously discussed capacity monitoring. We define it as reporting the state of a process by measuring or extracting key process variables/outputs. May also use equipment condition data if available. As the production process is at the heart of a manufacturing SME, the high ranking of this solution is expected. The feasibility of creating a low-cost version of this solutions depends on the individual requirements of the process, such as needed accuracy and frequency. For many processes a simple solution could suffice. A monitoring solution for temperature, axes position and speed, vibrations and acoustics was implemented based on a raspberry pi 2b and attached sensors into a legacy CNC machine in [16].